Table of Content

Experts expect the number of people refinancing their home loans to surge to a 17-year high in 2020, which means plenty of people are taking advantage of the rate drop. Homeowners who aren’t getting the best interest rates on their mortgages are spending hundreds, or even thousands, of dollars each year in unnecessary interest charges. Some of the Services involve advice from third parties and third party content.

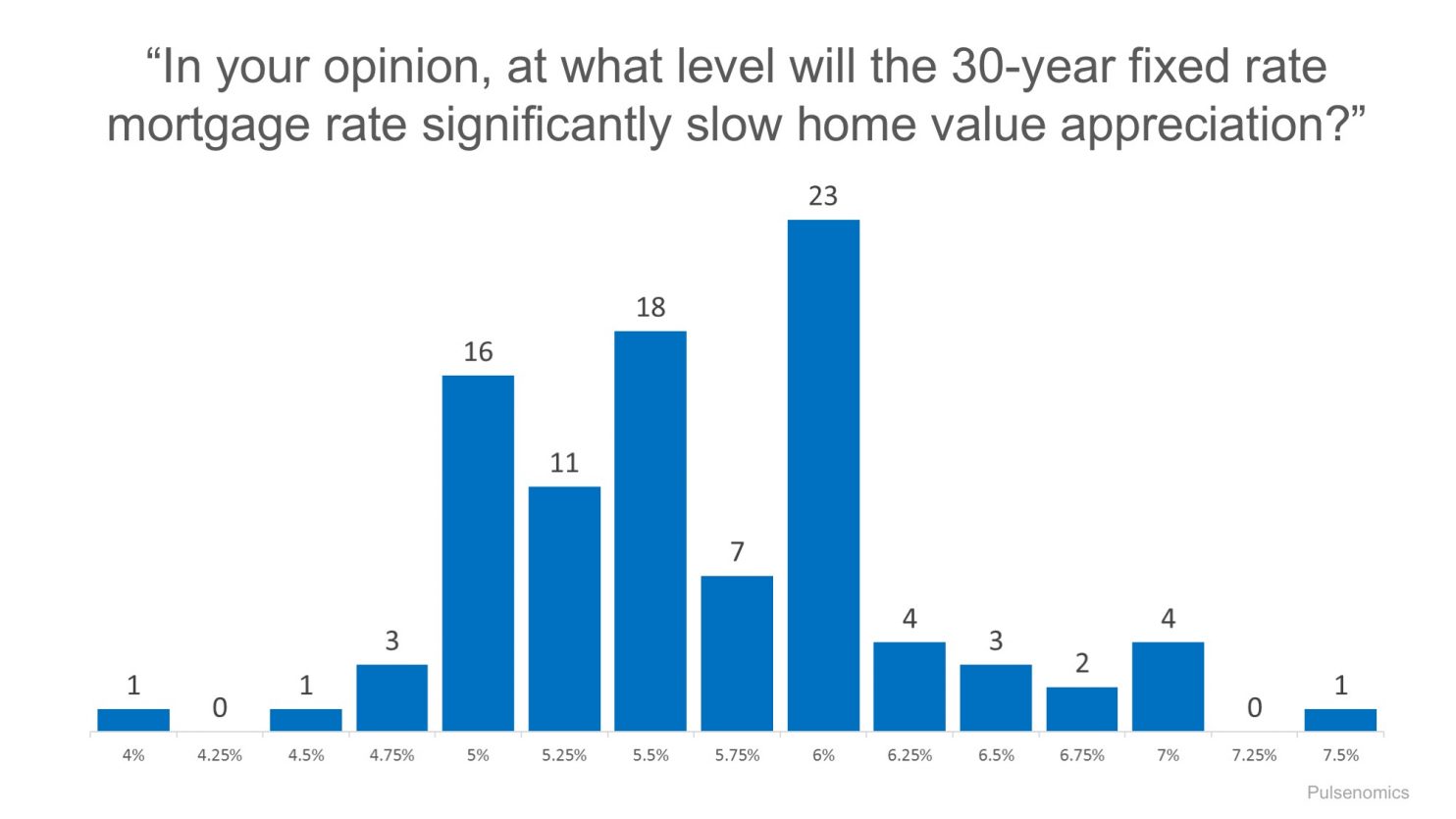

However, submitting multiple mortgage applications in an effort to get the lowest rate possible won’t hurt your score. Hale expects rates to settle between 5.5% and 6% from now to the end of 2022. If you have a large amount of equity in your home and would like to tap into its cash value, you might consider a home equity loan. A home equity loan is when you borrow a fixed amount of money against the equity you’ve built in your home. Homeowners often borrow against their equity to finance large purchases, make home renovations or finance other projects. If you borrow against your home equity you repay the loan over a specified term, but if you don’t repay the loan as agreed, your lender can foreclose on your home.

Compare up to 4 providers

To find out what rates are currently available,compare quotes from multiple lenders. Some common mortgage loan products are conventional, FHA, USDA, and VA loans. If you haven’t pulled your credit score and addressed any issues, then start there before reaching out to lenders. As of Dec. 15, 2022, the current average home equity loan interest rate is 7.77 percent. After selecting your top options, connect with lenders online or by phone. Next, choose a lender, finalize your details and lock your rate in.

If economic growth is slow, lower interest rates can boost the economy by encouraging borrowing and spending. If the economy is booming but policy makers are worried about inflation or debt bubbles, increasing rates can help cool things down. Get the latest housing market news and expert analysis delivered straight to your inbox.

Compare Current Mortgage Rates

This will help you lower the amount you pay in interest and pay off the mortgage faster. These costs typically amount to 2% to 6% of the new mortgage total. The loan-to-value ratio measures the amount of financing used to buy a home relative to the value of the home. The second step in ensuring you get the best rate available to you is to shop around. Make sure you compare the APR between lenders, not just the rate. The APR is the all-in total of your mortgage costs, which can vary by lender, and will include your closing costs if rolled into your loan.

Every mortgage lender will assess your situation differently, so it’s important to shop around. In order to accurately evaluate offers, you’ll need to submit an application. Once you do that, you can compare the Loan Estimate each lender provides. Certain types of refinancing typically have higher interest rates. If you want the lowest rate, avoidcash-out refinancingbecause it typically comes with a higher rate than a standard refinance.

Year Fixed-Rate Mortgage Refinance Rates

If you find any errors on your credit report, be sure to report them to both the credit bureau and the business that made the error as soon as possible. Both parties must correct the information in order for it to change on your credit report and be reflected in your credit score. Mike Fratantoni, chief economist for the Mortgage Bankers Association says rates might have already peaked this year, which could provide an opportunity for a few homeowners to refinance. The mortgage must be “net tangible benefit” to the borrower, which is based on the loan rate and term.

You could also choose to make extra payments toward your principal to decrease your LTV. If you’re rolling the refinance fees into your new loan with ano-cost refinance, then you’ll need to have enough equity to absorb the extra costs. The Federal Reserve does not set mortgage rates, and the central bank’s decisions don’t drive mortgage rates as directly as they do other products, like savings accounts and CD rates. However, the Fed does set borrowing costs for shorter-term loans in the U.S. by moving its federal funds rate. The federal funds rate can have a knock-on effect on 10-year Treasury bond yields, which is what most mortgage rates are tied to.

What is the best type of mortgage loan?

You can calculate this point by dividing your closing costs by the monthly savings from your new payment. You can bump up your credit score by paying off credit card debt and reducing how much you use your cards. If you do use credit cards for rewards and points, try to pay them off immediately—don’t wait for your monthly statement to come in because your score can change daily. There are a ton of different reasons to refinance, so ultimately the answer of when to refinance will be up to your goals and needs.

At Bankrate, we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity, this post may contain references to products from our partners. “Refinance activity, for the most part, is going to be contained to whomever borrowed in the last three to four months. If a recession hits or inflation gets back to 2% or below, you’ll see the Fed cut rates and refinance activity return,” says JR Gondeck, partner and managing director with the Lerner Group. During their last meeting of 2022, the Fed hiked their benchmark short-term interest rate, the federal funds rate, by half a percentage point. The most recent Consumer Price Index shows inflation at 7.1% year-over-year in November, an encouraging sign that inflation is cooling.

The total dollar amount you’ll pay in interest charges will vary not only with your interest rate, but also depending on the size of your loan and the length of your repayment term. Make sure to shop around tofind the best mortgage refinance ratesbecause interest rates vary from onemortgage lenderto the next. Lenders evaluate people’s circumstances differently, but by following these steps, you can ensure you’re getting the best rate you’re eligible for. While these minimums can help you get into a home sooner, the higher your down payment, the lower your mortgage rate and the less you’ll need to pay in mortgage insurance premiums. If you can put 20 percent down, you won’t pay any mortgage insurance at all, and likely get the most favorable rates.

Don’t be afraid to walk away from your current lender when you refinance. Consider using a mortgage broker, who will be able to provide rates from wholesale lenders. When finding current mortgage rates, the first step is to decide what type of mortgage best suits your goals and budget.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first.

The difference between APR and interest rate is that the APR is the total cost of the loan including interest rate and all fees. The interest rate is just the amount of interest the lender will charge you for the loan, not including any of the other costs. By capturing points and fees, the APR is a more accurate picture of how much the loan will cost you, and allows you to compare loan offers with differing interest rates and fees. Conventional loans are often ultimately bought by Fannie Mae or Freddie Mac, the big government-sponsored enterprises that play an important role in the mortgage lending market. They are offered by virtually every type of mortgage lender, with some programs allowing for a down payment as low as 3 percent.

Current Mortgage Refinance Rate Trends

The 15-year fixed mortgage refinance is currently averaging about 6.01%. That’s compared to the average of 5.93% at this time last week and the 52-week low of 5.86%. The 20-year fixed mortgage refinance is currently averaging about 6.49%. You can lock in a lower rate by refinancing, which should make your monthly payments lower and give you some money back in your budget.

Borrowers who think they could find lower rates or better terms should look into refinancing. Our goal is to provide reliable and timely information so you can make the best financial decisions for your lifestyle and wallet. We adhere to strict standards to ensure our work is always accurate, and our writers do not receive direct advertiser compensation or influence. Although rates change every day, you may have a bit of time to search around for the best rate.

No comments:

Post a Comment